An unpopular government takes on today’s biggest personal finance challenges in the federal budget released Tuesday. Here’s a report card that grades the budget on how it affects you and your household.

Taxes: C-

The headline budget measure is an increase in the inclusion rate for capital gains to two-thirds from one-half for gains above $250,000, starting June 25. A capital gain occurs when you sell an asset for more than you paid. The inclusion rate is the portion of the gain that is taxable.

Raising the capital gains inclusion rate addresses tax fairness, given that wealthy people benefit more from capital gains than those with middle and lower incomes. But this is a move that complicates an already overly complex tax system and provides a disincentive to invest at a time when economic productivity and growth are weak. Also, there’s potential for a wide swath of the population to be affected.

The government estimates the change in the inclusion rate would affect 40,000 people in 2025, or 0.13 per cent of the population of tax filers, with average gross income, including capital gains, of $1.4-million. But among those who would potentially be exposed to the higher inclusion rate are people selling cottages and investment properties, as well as those with significant investments outside registered plans.

The capital gain on the sale of a principal residence remains tax-free. Now, the government is providing a disincentive to invest in additional real estate. Introducing the higher inclusion rate in June gives people time to realize capital gains now and use the current inclusion rate.

Federal housing investments

since the 2008 global financial crisis

Billions of dollars

$12

10

2015-2024

average

$5.5

8

6

2007-2015

average

$2.3

4

2

0

2007-

2008

2011-

2012

2015-

2016

2019-

2020

2023-

2024

Note: Amounts for 2007-08 until 2022-23 are actuals, as available. Amount for 2023-24 is an estimate, and subject to change. Amounts are on a cash basis. Amounts include Canada Mortgage and Housing Corporation (CMHC) programming only, and do not include: homelessness programming; energy efficiency programs delivered through Natural Resources Canada; tax measures; cost-matching provided by provinces and territories; or investments that support distinctions-based Indigenous housing strategies.

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

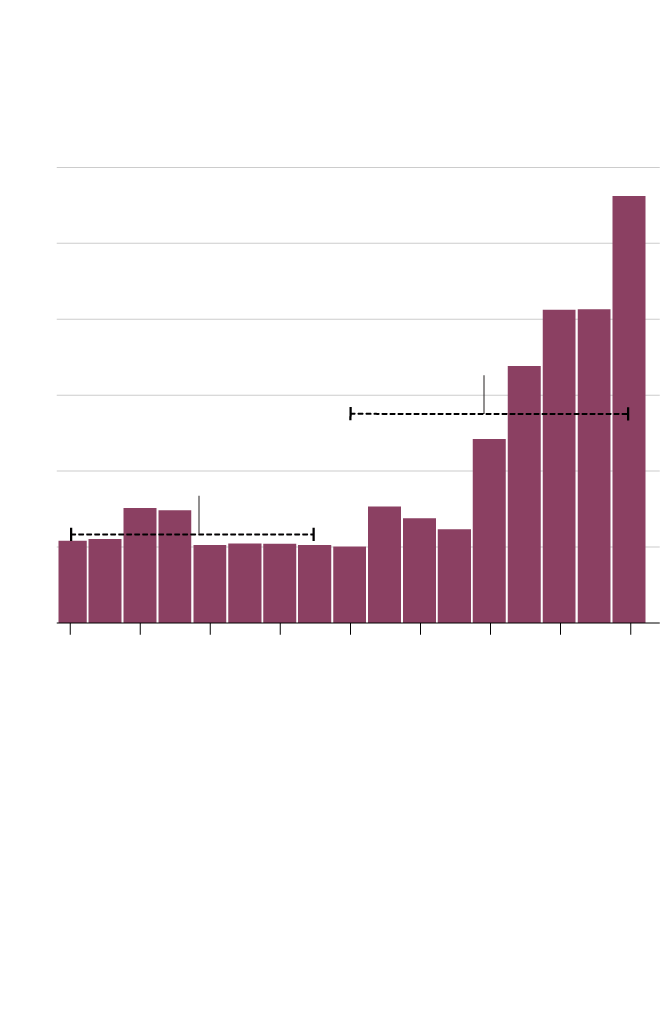

Federal housing investments

since the 2008 global financial crisis

Billions of dollars

$12

10

2015-2024

average

$5.5

8

6

2007-2015

average

$2.3

4

2

0

2007-

2008

2009-

2010

2011-

2012

2013-

2014

2015-

2016

2017-

2018

2019-

2020

2021-

2022

2023-

2024

Note: Amounts for 2007-08 until 2022-23 are actuals, as available. Amount for 2023-24 is an estimate, and subject to change. Amounts are on a cash basis. Amounts include Canada Mortgage and Housing Corporation (CMHC) programming only, and do not include: homelessness programming; energy efficiency programs delivered through Natural Resources Canada; tax measures; cost-matching provided by provinces and territories; or investments that support distinctions-based Indigenous housing strategies.

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

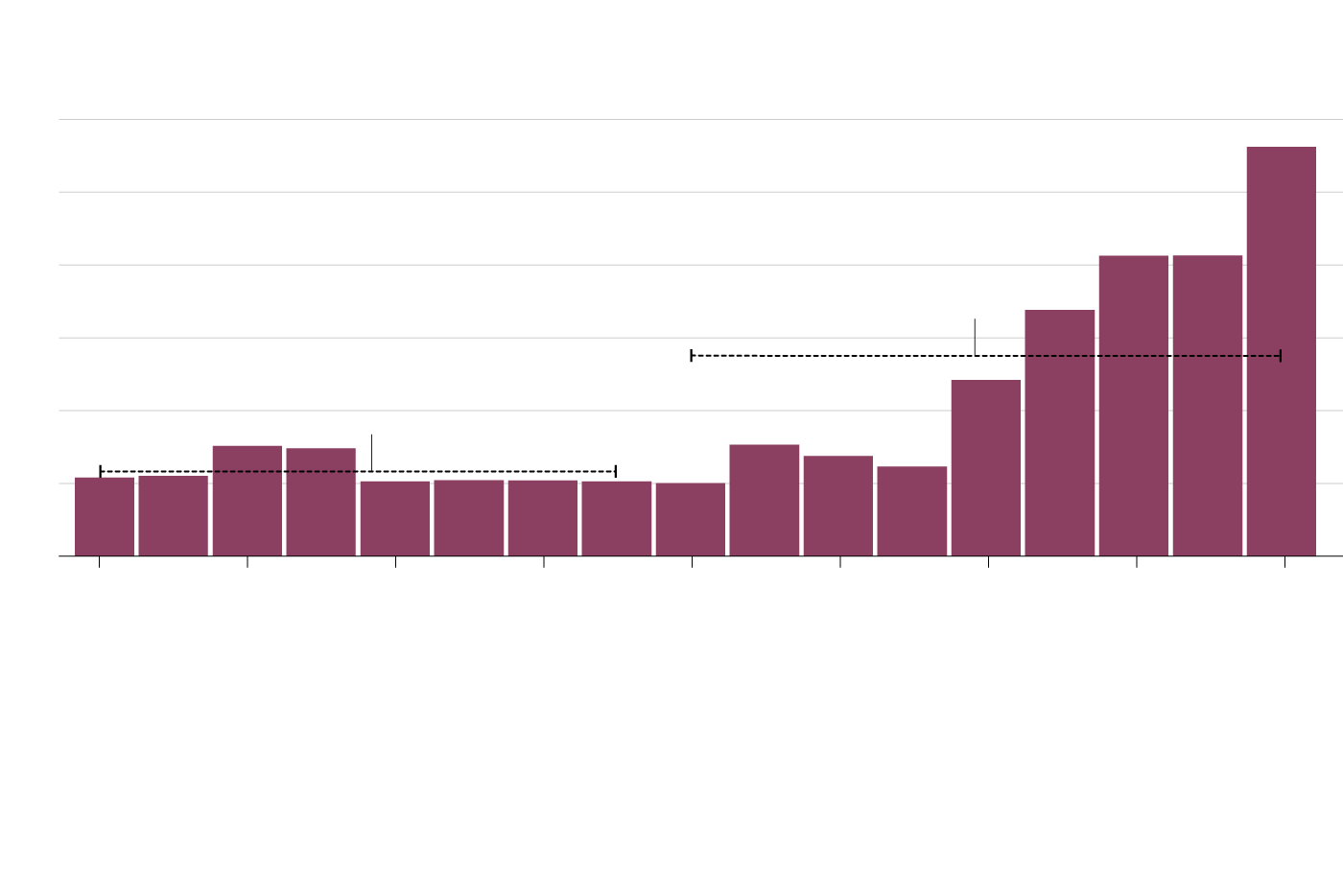

Federal housing investments since the 2008 global financial crisis

Billions of dollars

$12

10

2015-2024

average

$5.5

8

6

2007-2015

average

$2.3

4

2

0

2007-

2008

2009-

2010

2011-

2012

2013-

2014

2015-

2016

2017-

2018

2019-

2020

2021-

2022

2023-

2024

Note: Amounts for 2007-08 until 2022-23 are actuals, as available. Amount for 2023-24 is an estimate, and subject to change. Amounts are on a cash basis. Amounts include Canada Mortgage and Housing Corporation (CMHC) programming only, and do not include: homelessness programming; energy efficiency programs delivered through Natural Resources Canada; tax measures; cost-matching provided by provinces and territories; or investments that support distinctions-based Indigenous housing strategies.

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Housing: B

The government has set a goal of building 3.9 million homes by 2031, which in pure economic terms should help affordability. Build supply to satisfy demand and prices should stabilize over time. For now, there are only niche measures to help first-time buyers cope with high mortgage rates and home prices that averaged just under $700,000 in the national resale market last month.

Extensive help to young buyers would result in home prices rising – that’s a done deal. But making 30-year mortgages available to rookie buyers purchasing newly built homes with a down payment of less than 20 per cent would typically save only $100 to $300 a month in rough terms. This measure takes effect Aug. 1.

Modest down payment help is coming through an immediate boost in the amount first-time buyers can withdraw from a registered retirement savings plan under the federal Home Buyers’ Plan. The limit goes to $60,000 from $35,000, and HBP users will temporarily have three years added to the current two-year grace period for starting repayment of money into an RRSP. The longer grace period applies to withdrawals under the HBP in 2022 through 2025.

Junk fees: C

Lots of talk about working with various parties to address nuisance fees in areas such as telecom, airline tickets and concerts, but also a few nuggets of concrete action. Examples include a prohibition on telecom companies charging an extra fee to customers to switch carriers, and a $10 cap on the amount banks can charge in non-sufficient funds fees. Banks would also have to alert customers the NSF fee is being charged and provide a grace period to avoid the fee by depositing additional funds.

Open banking: D

There were hopes the government would announce a legislative framework for open banking, which holds the promise of increasing competition in financial services and fostering new apps and tools to help people manage their money.

The budget did announce the government will soon table legislation to expand the mandate of the federal Financial Consumer Agency of Canada in setting standards for open banking, and provided funding for a three-year study of open banking oversight by the Department of Finance. With open banking, consumers could securely share personal bank account data with other financial players.

In a somewhat more immediate move, the budget disclosed that the FCAC is in negotiations with banks to increase offerings of accounts with fees ranging from zero to $4 a month. One goal is to include more transactions in these accounts without extra costs.

Saving for a postsecondary education: A

File this one under small but helpful. Eligible children born in 2024 and beyond will have a registered education savings plan automatically set up for them by age 4. Kids who qualify would receive up to $2,000 in total via the Canada Learning Bond, which is available to low-income families to help save for a child’s postsecondary education. Eligibility for the CLB payment is based on parental income.

Are you a young Canadian with money on your mind? To set yourself up for success and steer clear of costly mistakes, listen to our award-winning Stress Test podcast.

Rob Carrick

Rob Carrick