Briefing highlights

- Prepare for more on renewing mortgage

- Our annual ranking of corporate boards

- Markets at a glance

Sticker shock

A Canadian credit rating agency fears homeowners could be in for a "substantial" shock when they go to renew their mortgages.

"Mortgage borrowers in Canada could be shocked at their five-year renewal to find their mortgage payments are going up as rates begin to rise," DBRS Ltd. warned in a report on the mortgage market.

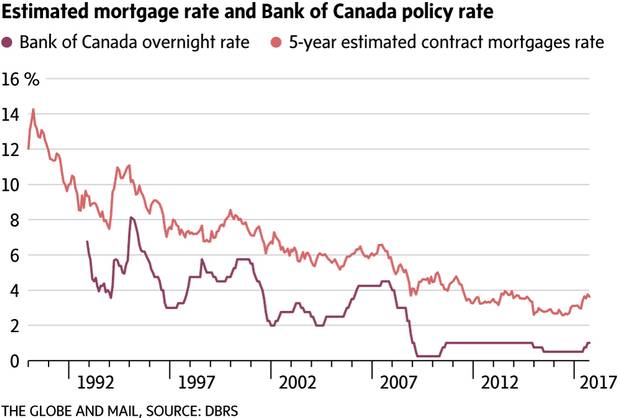

"Over the last three decades, Canadian households have generally benefited from lower rates and have not had to adjust their spending patterns to cope with higher mortgages rates," the agency added in its recent report.

"This may change in the next few years. While a 100-basis-point increase in rates would mean about a 9-per-cent increase in payments, a 300-basis-point increase in rates would result in a much more significant 29-per-cent increase in payments for borrowers with 20 years of remaining amortization on their mortgages. Borrowers with fewer years of remaining amortization would face a smaller increase in their payments."

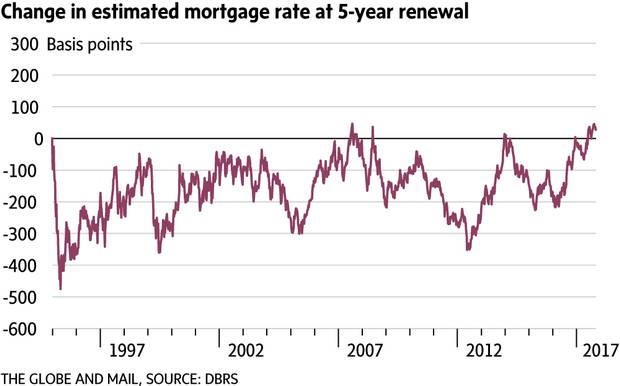

Because of how Canadian mortgages are structured, rate "shocks" could be marked for some borrowers. Of course, the impact would be softened somewhat because only 20 per cent of five-year renewal mortgages would "reset" each year, DBRS said.

"Nevertheless, in a scenario where rates increase and then plateau, the higher level of rates would continue to produce rate shocks for households who reach their renewal date."

As other observers have noted, this will have a ripple effect through the economy, notably on consumer spending as some families are pinched.

The Bank of Canada has raised its benchmark overnight rate twice this year, and is now in pause mode, though expected to resume hiking next year. And, DBRS noted, yields on five-year government bonds, to which mortgages are linked, were up at the time of the recent report by 60 to 70 basis points since early June.

"With interest rates trending down over the last three decades, Canadian households generally have not had to adjust their spending patterns to cope with higher mortgage rates at renewal," DBRS said, noting that the most common mortgages in Canada carry five-year terms and 25-year amortization.

"According to DBRS calculations, households in Canada with five-year, fixed-rate mortgages have typically experienced higher renewal rates during only six months over the last 22 years," it added.

"Moreover, the highest increase was only 46 basis points for mortgages renewed in August, 2007. With mortgage renewal rates now starting to be higher than mortgage rates five years ago, Canadian households could be entering unfamiliar territory: a sustained period with worse refinancing conditions."

Here's how it looks to the DBRS team that prepared the study, based on monthly payments for "representative mortgage borrowers" under different scenarios:

What this shows, just using the first example, is the impact of a rise of 100 basis points, or a full percentage point, on three renewal scenarios, including an outstanding mortgage of $400,000 with remaining amortization of 20 years.

Remember, too, for this exercise that home prices, notably in the Toronto and Vancouver areas, are up markedly and provincial and federal governments have moved to tame those markets. New rules also come into effect in January, from the commercial bank regulator. Inflation, too, will play a role.

Now, rates certainly aren't going up by 300 basis points, or three percentage points, anytime soon.

The objective of the report wasn't to gauge the timeline of rising rates, but rather the impact on consumers under the various scenarios, said Sohail Ahmer, vice-president of the DBRS financial institutions group.

The degree of shock will depend on the individual household, Mr. Ahmer added. Consider, for example, someone who recently borrowed for a very high-priced home in Toronto or Vancouver.

"Recent buyers in markets where house prices have been increasing rapidly may face greater risk, as their sensitivity to mortgage payment shock is higher than for earlier buyers," DBRS said.

"These households are also more likely to have high levels of debt to disposable income as they have stretched to buy in these more expensive housing markets. This leaves them with less capacity to absorb increased monthly payments."

For the record, the latest forecast from Bank of Nova Scotia puts the central bank's overnight rate, which now stands at 1 per cent, at 1.5 per cent by the end of next year, 2.25 per cent by the end 2019 and above 2.5 per cent by late 2020.

Read more

- Housing affordability: It’ll be far nastier in Toronto and Vancouver as rates rise this time

- Janet McFarland, Brent Jang: Toronto, Vancouver see home-sales rush ahead of new stress-test rules

Board Games

Read our annual ranking of corporate boards in Canada, and what's on the minds of senior executives.

Markets at a glance

Read more